What are hard-to-abate sectors, and why are they difficult to decarbonise?

Hard-to-abate sectors include steel, cement, chemicals, aviation, and shipping, which face significant technological, financial, and operational barriers to decarbonisation. These industries rely on high-temperature processes, fossil fuel feedstocks, and long investment cycles, making it difficult to switch to low-carbon alternatives without major capital expenditure. Unlike sectors that can transition by simply adopting renewable energy, hard-to-abate industries require fundamental shifts in production methods, infrastructure, and supply chains.

For example, the cement industry emits CO₂ not only from energy use but also through chemical reactions in clinker production, making emissions reduction particularly complex. Similarly, steel production relies on coal-based blast furnaces, which have lifetimes spanning decades, limiting the pace at which new, cleaner technologies can be deployed. Overcoming these challenges requires long-term investment, technological innovation, and financial incentives to make decarbonisation economically viable.

How does transition finance support decarbonisation in hard-to-abate sectors?

Transition finance helps high-emission industries like steel, cement, and chemicals secure capital for low-carbon technologies. Unlike traditional green finance, which funds already sustainable projects, transition finance supports sectors that need major operational shifts to reach net zero.

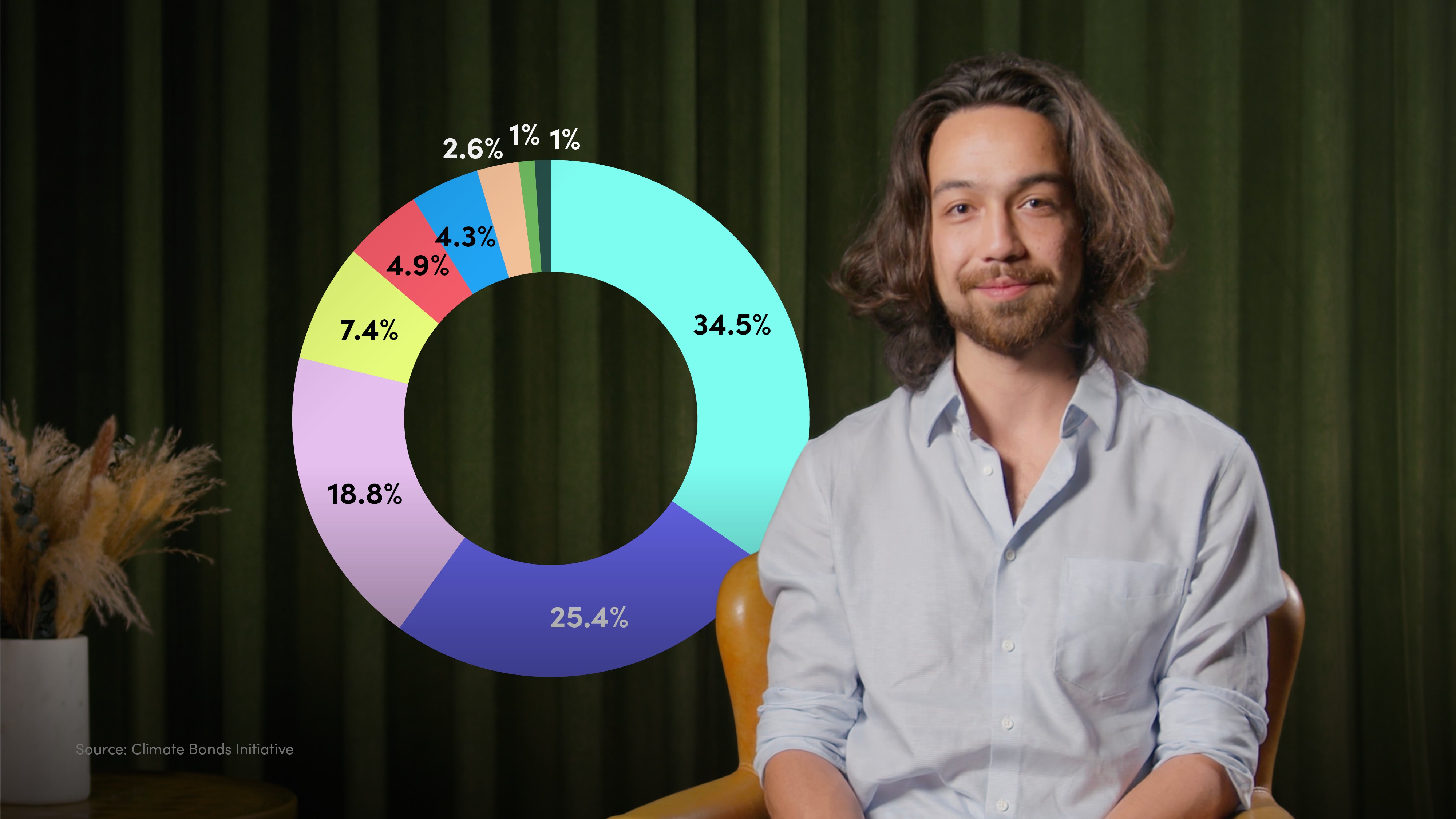

Historically, heavy industries were seen as too risky for sustainable finance, but regulatory developments and investor demand are changing that. In 2024, steelmaker POSCO issued a $500 million green bond to fund electric arc furnaces and blast furnace upgrades, aligned with Climate Bonds Initiative’s criteria.

To reinforce credibility, organisations like Climate Bonds Initiative set sector-specific standards, ensuring funding supports genuine decarbonisation. Policy support is also key to attracting private investment and accelerating the transition.

What role does Climate Bonds Initiative play in ensuring credible financing?

The Climate Bonds Initiative develops certification criteria for green bonds, ensuring investments align with real emissions reductions. It provides technical assistance, market monitoring, and credibility standards, helping capital flow to projects that truly support decarbonisation.